What's up With Gold?

Let's dive down the rabbit hole to see what gold might be telling us.

With gold ripping to new highs while foreign exchange markets settling into a tedious range, I figured I was overdue for a deep dive down the rabbit hole.

Let me begin by saying that if you're here for an “answer,” you'll leave disappointed. The data isn't sufficiently robust to provide us with definitive answers. I will, however, present a theory as to why gold is doing what it’s doing, and that theory can inform us as to what market signals we should (and should not) derive from the outsized move in gold.

So, what’s up with gold? If the past is prologue, we’re heading for a 1970s-style inflation breakout. The financial talking heads on X and the crypto bros are certainly excited about the prospect.

But is past prologue? Or has gold become something different that what it used to be? Is it perhaps subject to the inverse of Goodhart’s law (“when a measure becomes a target, it ceases to be a good measure”)? Is gold only a good measure (of impending inflation) when it's used as a target?

The Dollar’s initial break from gold in 1971 and its rapid depreciation against gold were met, nearly in real time, with a burst of inflation never before seen in the US outside of wartime. Clearly, the gold price still meant something of economic importance in the immediate aftermath of its being dropped as a target for the value of the Dollar.

Gold’s decline from a well-worn range in the latter half of the 1990s was a proximate trigger for the Asian financial crisis, marked by rolling devaluations of currencies that couldn’t keep pace with the appreciating/deflating Dollar. Gold still seemed to “work” at that point.

For much of the 2000s, it looked like gold was still working as an indicator of overly-easy monetary conditions, as commodities boomed while Wall Street and Main Street bubbled. Yet, we never witnessed any resultant acceleration of inflation. Was that because the 2008 bust short-circuited the inflation process? That might be a compelling argument if gold had retraced. Instead, after only a brief correction in 2008, it continued higher until peaking in 2012. Still, the inflation never came. Something seemed to have changed.

The recent price action has been even more bizarre.

After a slight rally from mid-2018 through 2019 (consistent with the US-China trade war heating up), Goldrallied through the opening months of the pandemic, only to then trade sideways / lower as US M2 exploded, unleashing the worst bursts of inflation in 40 years.

Gold had no noticeable reaction to the Fed jacking the funds rate from near zero to above 5%, soft-landing the US economy in the process. In early 2024, gold broke out of its range and has since proceeded to rally by 75%, all while US nominal GDP has enjoyed a historical run of stability, albeit at levels perhaps a touch too high to be consistent with 2% PCE inflation, but stability nonetheless. (And more recently, nominal growth is decelerating somewhat, not accelerating as gold prices would suggest).

A broad perspective of the past quarter-century of gold price actions suggests that gold may have lost its luster as an inflation indicator.

A Quick Refresher on Theory

For the first half of my career, the gold price was central to my macro worldview. As an acolyte of supply-side guru Jude Wanniski, I was wedded to the view that the gold price was the purest mirror image of the US dollar, a rise in the gold price indicating a decline in the US Dollar, the nation’s monetary standard, that would lead to inflation as sure as day follows night.

Wanniski argued, convincingly, that gold was best placed to serve as a monetary unit of account because of its unique features.

Because it is an element with limited industrial uses, its stock is enormous relative to its flow. While most of the stock of wheat or corn might be consumed each year, leaving prices exposed to significant volatility if annual supply is disrupted by a drought or boosted by a bumper crop, the vast majority of gold ever mined is still available for sale at the right price. (While gold is “consumed” as jewelry, that’s best considered ornamental money. Get in a pinch, and you can always hock your gold watch).

If the supply is huge relative to annual demand, then the real value of the metal should be highly stable. And for centuries, this seemed to be the case.

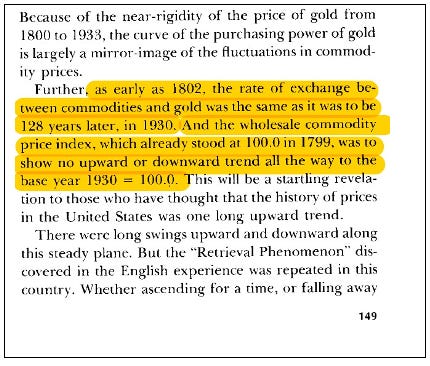

In his 1977 tome, The Golden Constant, Roy Jastram constructed commodity price series back to 1560 for the U.K., which showed that commodities mean-reverted relative to gold over centuries. In the U.S., as Jastram showed, the gold standard produced an unchanged wholesale price index (not without interim inflations and deflations) over a 128-year period to 1930.

The logic, which I have always found compelling, is that because the real value of gold is highly stable, a large move in the nominal US Dollar gold price can only result from a large move in the real value Dollar. That is, if gold is rising, it must be because the Dollar is losing real value, i.e., “inflating.”

Theory meets practice

As compelling as I find the theory that gold’s value is generally stable in real terms, I can’t square it with the recent empirical reality. Something strange is going on.

First, we have the noted divergence between real interest rates and the gold price:

This is a compelling chart, but not necessarily the smoking gun many think it is.

The neutral real interest rate is not necessarily stable. If the neutral real interest rate rose dramatically in 2021, we could see gold trade higher in the classic response to overly-easy monetary policy, even as the actual real interest rate rises.

However, if the Fed were in such an inflationary stance, we would expect nominal GDP growth to be accelerating. It is not, which suggests there is something “non-monetary” going on with gold.

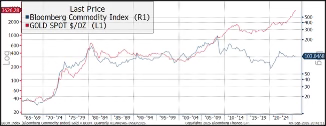

Gold’s fractured relationship with other commodities is also remarkable.

The gold price and the Bloomberg Commodity index mean-reverted for decades prior to the global financial crisis.

More recently, gold is going off the rails vs. oil:

The ratio of the prices of yellow gold and “black gold” has mean-reverted consistently for decades (except for the brief pandemic collapse in oil prices to near-zero levels).

Gold is now off on its own in a manner that suggests we are, in fact, seeing a historically unusual real revaluation of gold as opposed to a Dollar collapse that would produce accelerating inflation.

So Who’s Buying?

I’ve never found the question of “who’s buying” to be particularly useful, especially in the case of gold, which, as noted above, should not be dramatically moved by a bit of extra buying. Nonetheless, this is what everyone’s talking about.

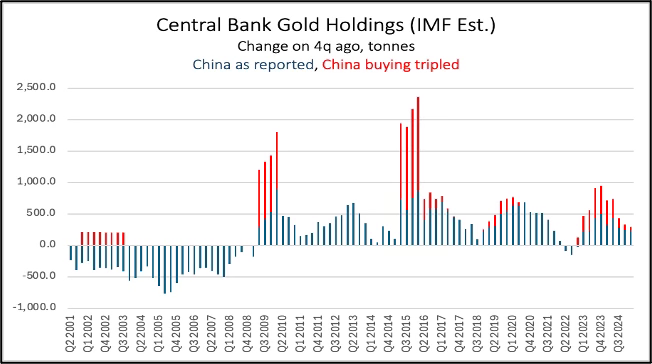

Yet, for all the talk of heavy central bank buying of gold lately, nothing historically unusual appears in the data.

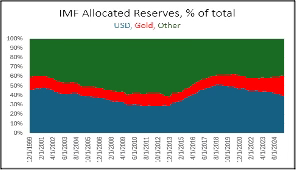

Nor is there any sign of the Dollar losing its status as the premier reserve currency.

While gold’s share of global reported reserves has increased somewhat in recent years, that is almost exclusively a function of gold price appreciation. Dating back to 2018, reported gold volumes held by central banks have only increased 6.9%.

Ok, but what about China? As far as their reporting goes, nothing unusual there either:

Of course, there’s no reason to trust Chinese reporting. Here’s an illustration from a 2024 research report from Goldman purporting to show that China understates the duration and magnitude of its gold buying sprees.

Gold Analyst Jan Nieuwnhaus writes on hidden PBoC gold buying on his Substack if you want to borrow down that rabbit hole. I find the analysis compelling, though much is based on insider hearsay which I can’t corroborate. That said, the CCP lies about everything, and if they are trying to build a large gold position, there is no reason they would tell the world about it.

So, just for kicks, I have recalculated total central bank gold buying assuming a tripling of the reported figures for PBoC buying (shown as rolling 4-quarter central bank net buying).

There just isn’t anything terribly unusual going on here. With some 216,000 tonnes of estimated above-ground gold, it’s a stretch to think central bank gold buying of less than 1,000 tonnes a year can account for such a rapid increase in the price.

I should note that the World Gold Council, an industry advocacy group, estimates central bank buying a bit higher than even my “tripling China” estimates, at a bit over 1,000 tonnes per year since 2022. That said, their data includes estimates of “unreported purchases” for which they provide no transparency as to the methodology, so take them for what it's worth. (Not much, in my book).

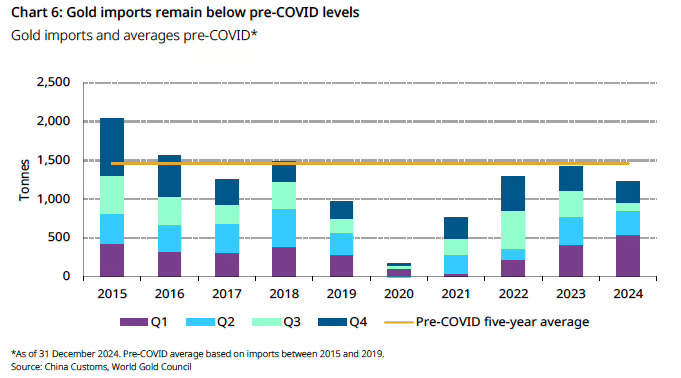

As for Chinese imports of non-monetary gold, they’re well up on the pandemic period but are little changed from levels prevailing previously:

Lastly, if retail buyers are driving the frenzy, they’re not leaving any fingerprints in the ETF market either.

If it not outsized buying, why aren’t people selling at these prices?

If there is no apparent paper trail of outsized gold buying, and yet prices have nearly doubled in two years, it begs the question: why aren’t more people selling? Is it some global “golden hands” phenomenon driven by the crypto frenzy?

“Markets have lost their mind” is never a satisfying answer to these questions, though we do seem to be witnessing trading frenzies with increasing frequency. (Yesterday’s Bloomberg News story “Mini Lububu Prices Sink 24% from Peak as Speculative Mania Cools” is typical.)

I prefer a fundamental explanation, and here we delve into speculation. It’s the Russian sanctions thing. But it's not just the Russian sanctions thing.

A few points: First, this isn’t a “Dollar thing.” In fact, the EU was the driving force behind the Russian sanctions and actions on their reserves. You know who’s really worried about confiscating Russia’s reserves? The Belgians, because it would undercut the credibility of Euroclear:

Belgium Fears ‘Domino Effect’ of Seizing Russia’s Frozen Assets

“For Belgium, confiscating Russian sovereign assets is not an option,” Prevot said in an interview at his Brussels office.

“Such a confiscation, motivated by a political decision rather than a legal or judicial one, would be likely to cause a terrible systemic shock across all European financial markets, deal a severe blow to the credibility of the euro, and thus have very problematic domino effects.”

There is nothing “Dollar-specific” to the recent gold rally.

Secondly, note that gold had little reaction to the initial freezing of Russian reserves in February 2022, selling off throughout most of 2022.

From one perspective, one might argue that it “broke out” in early 2024, consistent with the EU’s February 2024 decision, approved shortly thereafter by the G7, to seize “windfall profits” on Russia’s reserves and use them for Ukrainian reconstruction.

I’m open to the idea that “seizing” is crossing a credibility rubicon that “freezing” isn’t. That said, how many economic actors of global heft are really concerned they might get frozen out of the global financial system and have their reserve assets seized. A few, maybe. One big one comes to mind.

But from another perspective, gold bottomed in late 2023, marked time through most of 2023, and then began rallying again in late 2023, never to look back. Here’s what else was going on at that time (timeline via ChatGPT):

· August 2022: US CHIPS Act Signed

· October / November 2022: New export controls on China begin to be rolled out

· August 2023: Executive order restricting US outbound investment in high tech to “countries of concern”

· Late 2023 through 2024: incremental tightening of US export control on China

It wasn’t just the heavy-handed treatment of Russia’s reserves that drove the gold rally. It was the heavy-handed treatment of Russia’s reserves in combination with the increasing liklihood of US-China decoupling.

In a bifurcated global financial system, it’s not just the bad actors that have to worry about access to the global financial system, but anyone who wants to continue to transact with a bad actor. And given China’s centrality to global trade, that’s just about everyone.

In a world where financial walls go up between China and the West, gold acquires critical utility as a monetary unit that can cross the wall with relative impunity. (As an aside, I’m not a bitcoin bro, but bitcoin also obtains a similar utility in a scenario of global decoupling).

For China, access to sufficient liquidity in such a monetary unit is of existential importance. For many other economic actors, both public and private, it's also pretty damn important.

We don’t need to obsess about “who’s buying gold,” and doing so is unlikely to provide satisfactory answers anyway.

Gold is becoming more valuable in real terms as its utility is greatly increased in a decoupled global financial system, which looks more likely by the day.

It’s a theory anyway.

Gold/bitcoin is up about 30% ytd. Gold is due for a correction imo.