A Not-so Hawkish Cut

Powell's half-hearted attemt to appease the hawks by guiding to a pause fell flat, leaving a low bar to further rate cuts

Chair Powell, last week , was trying to reflect the diverse views of a divided committee, but he couldn’t help letting his inner dove slip out on occasion. It was a weak attempt at a hawkish cut. His heat just wansn’t in it.

So while the Chair tried to leave the impression that the 75bps in cuts over the last three meetings will fix what ails the labor market, he in fact set a low bar to further cuts.

The Chair’s first attempt at consensus-building was to signal an “on-hold” stance in his prepared remarks:

With today’s decision, we have lowered our policy rate 3/4 percentage point over our last three meetings. This further normalization of our policy stance should help stabilize the labor market while allowing inflation to resume its downward trend toward 2 percent once the effects of tariffs have passed through. The adjustments to our policy stance since September bring it within a range of plausible estimates of neutral and leave us well positioned to determine the extent and timing of additional adjustments to our policy rate based on the incoming data, the evolving outlook, and the balance of risks.

TL;DR: We’re basically at neutral now, and we’ve fixed the labor market with a 75bp recalibration.

Well, maybe. But I doubt it.

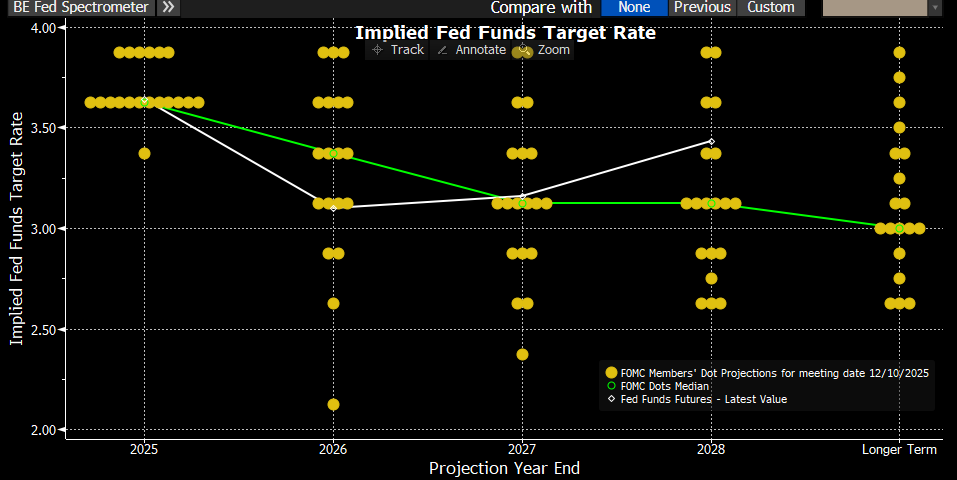

As you can see in the right-hand array of dots below, the FOMC’s neutral rate estimates range from 2.625% to 3.875%. At 3.625% currently, a majority of FOMC members would still characterize the policy stance as restrictive to varying degrees.

And even if the 75bp recalibration did put the Fed at neutral, that’s unlikely to halt the deterioration in the labor market on a dime. Long and variable lags and all that.

Unless the unemployment rate gets stopped in its tracks, further rate cuts are a live proposition, because while pretending to suggest the bar to further action was high, the chairman told us that only a one to two-tenths increase in a metric that has risen by three-tenths in the past three months might trigger further cutting action.

When asked what gives him confidence that the unemployment rate won’t keep rising, Powell answered:

I think the idea is that with now having cut seventy-five basis points more now and having policy, you know, I’d call it in a broad range of plausible estimates of neutral, that that will be a place where -- which will enable the labor market to stabilize or to only kick up one or two more tenths.

And it’s not just Powell putting down a marker that even a moderate further rise in the unemployment rate will open the door to more cutting. Here’s Austan Goolsbee, who dissented last week in favor of keeping rates on hold, on CNBC :

Q: What’s your sort of upper tolerance for the unemployment rate? Where does it start to get worrisome to you?

Goolsbee: Look, it’s always worrisome whenever it’s rising. It’s been rising a little bit. It’s been rising gradually. If the unemployment rate is 4… 4 1/2 or under and stays there, stably, as long as it’s coupled with some of these other rates - the vacancy rate, the hiring rate, the layoff rate - if those show stability, we’re not in the space that that I’m readjusting [indecipherable].

If a 4.6% unemployment rate (currently 4.4%) is the trigger for the next rate cut, January may well be in play. Certainly, on current trends, a cut by March is more likely than not.

But what about those dots showing a median expectation of only one further rate cut throughout all of 2026? We also learned this week that we need to heavily discount the dots.

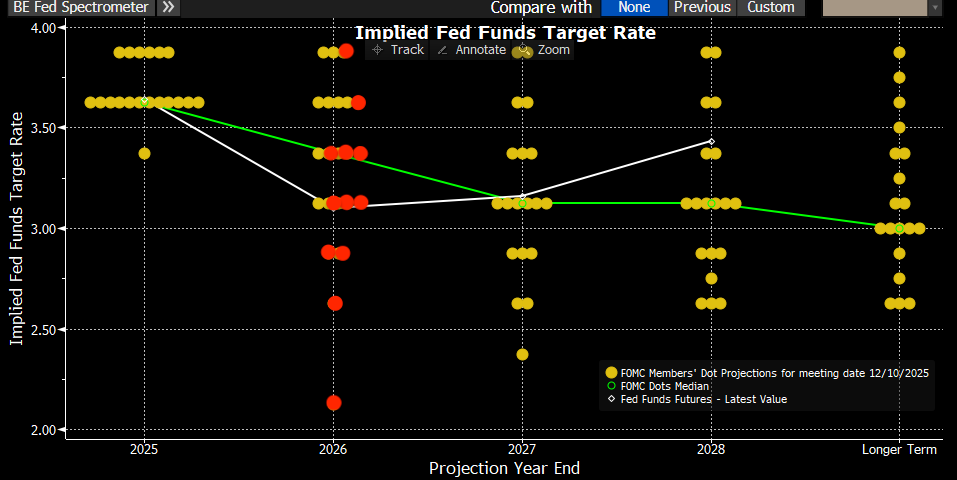

The red dots below denote my guess at the dots of the 2026 voters. It’s a markedly different picture than that of the full 19, given that the hawkish end of the distributuion is stocked with non-voters..

In all likelihood, the median dot among voters points to two cuts in 2026, in line with market pricing. And in a few months, we’ll be getting a new Fed Chair for whom “building consensus” among regional bank presidents will be low on the list of priorities.

So filter out the noise from the Schmidt’s and Musalem’s of the world. There is a small subset of FOMC participants who both vote and are potentially malleable in how they might vote, that we should focus our attention on as we head into 2026:

· Kashkari

· Williams

· Jefferson

· Cook

That’s it. That’s the list.

Assuming that Jay Powell resigns, paving the way for another Trump appointment (perhaps Miran returns after handing his current seat to the incoming Chair, likely Hassett), the next Fed Chair will need only two of the the four voters above to win the case for any further rate cut.

Even gradual increases in the unemployment rate - the ultimate arbiter of the degree of economic slack in the Fed’s framework - will produce a consistent stream of rate cuts in 2026, likely at a rate of 25bps per quarter.